The CRU

The CRU is the trusted and established steel sheet benchmark

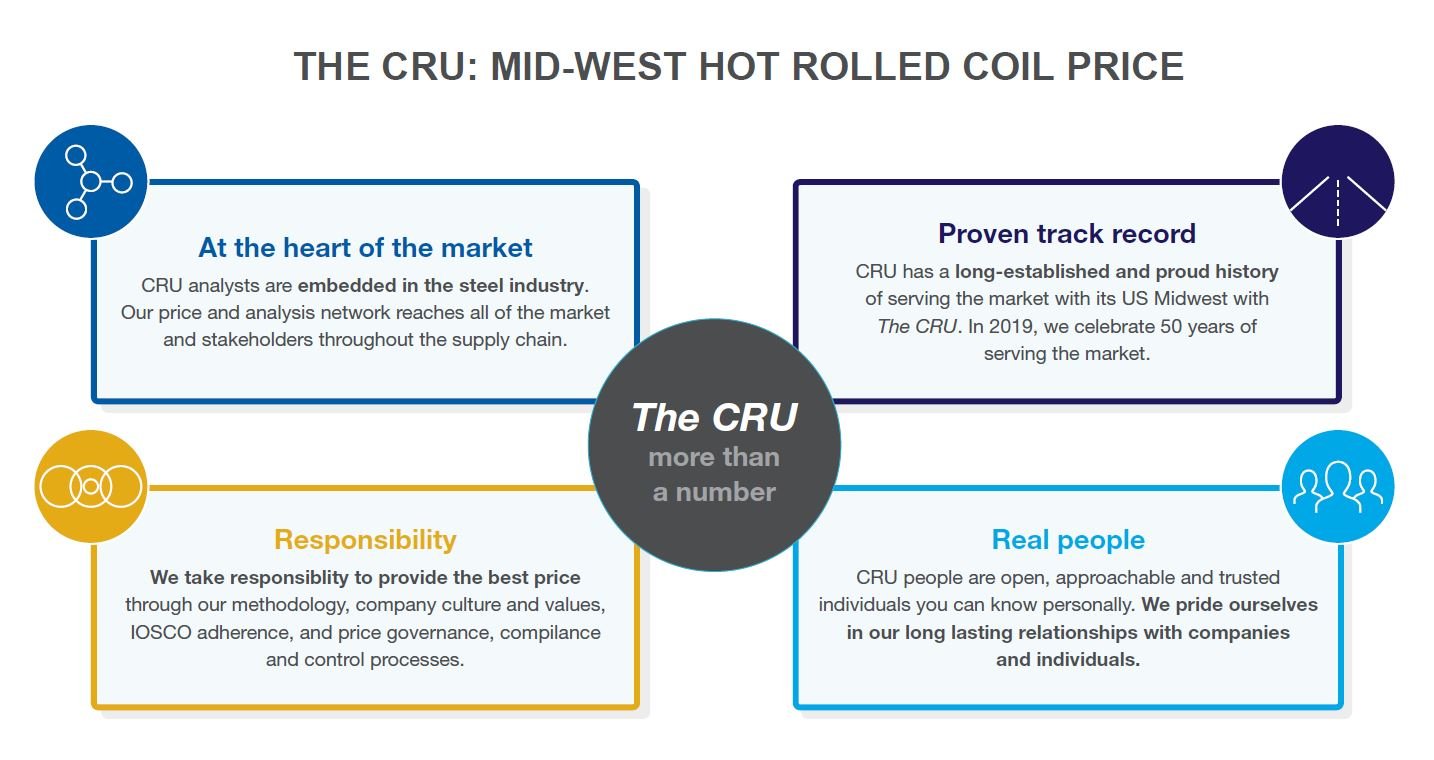

Proven through increasing interest and volumes as the CME Group HRC futures and options contracts settlement price along with independent research, The CRU helps our customers across the steel supply chain to manage their businesses. The strength and reputation of our steel prices and analysis is upheld by a foundation built upon relationships, experience, responsibility, and our people. The CRU is more than a number.

The CRU: The trusted and established steel sheet benchmark

We wanted to confirm our belief that CRU’s hot rolled coil price – published every Wednesday in CRU’s Steel Sheet Products Monitor, and known by many as ‘The CRU’ – is the leading steel benchmark in the US market.

Learn MoreThe CRU

.

Point of distinction in pricing

CRU has been built on strict methodologies using first-hand data and information to deliver reliable market-leading price assessment, analysis, forecasts, costs services and global industry events. To that extent, CRU is both a price-reporting agency (PRA) and a research and analysis company.

Our market and price analysis work are largely informed by proprietary models and models developed in-house – an approach distinguished from any other PRA. CRU price assessments are supported by our deep understanding of commodity and market analysis fundamentals, broader market intelligence and complete supply chain operations.

Proud history serving the North American market

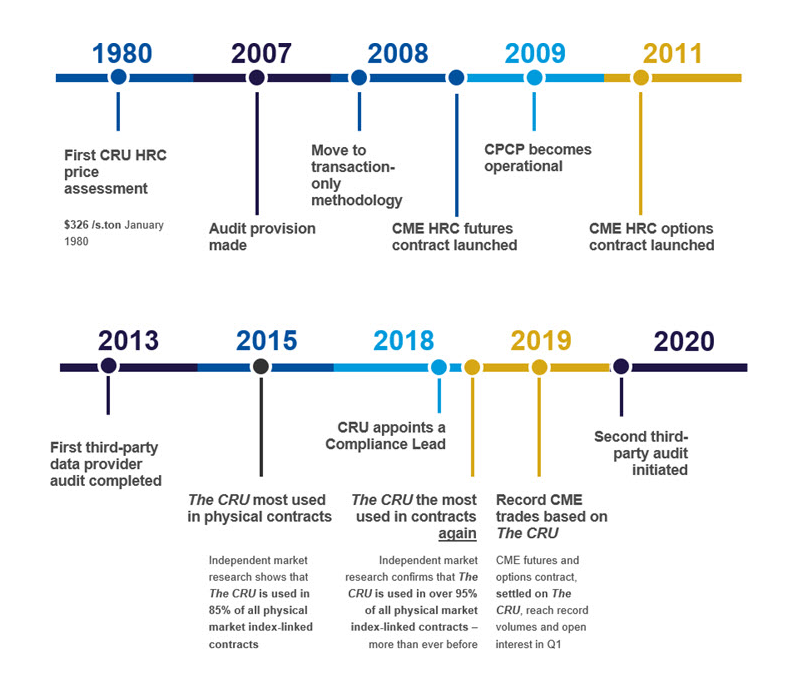

CRU has a long-established and proud history of serving the market with its US Midwest HRC price, The CRU. With an established North American presence since 1996, our first US Midwest price assessment was in January 1980 - $326 /s.ton.

The CRU is used in the settlement of CME’s US Midwest Domestic Hot-Rolled Coil Steel (CRU) futures contract and was the first index to have its data providers and methodology audited by a third party. Enabling users to effectively hedge against volatility and risk, CRU-settled contracts reached near record levels in 2019 after substantial growth throughout 2018. The CRU is now referenced much further afield in Mexico, Asia and other markets seeking to export to North America.