The collapse of Silicon Valley Bank (SVB) sent a shock wave through financial markets. The failure of the 16th largest bank in the US was the largest banking collapse since the Global Financial Crisis. Following SVB’s closure on 10 March 2023, the Dow Jones U.S. Banks Index dropped 7% and the S&P Regional Banks Index plummeted even further, by 11% (Figure 1).

The SVB collapse should not lead directly to the failure of other financial institutions through counterparty exposures – so called ‘direct contagion’. However, the SVB collapse has two important messages. Firstly, it shows that tighter monetary policy is hurting. The increase in policy rates, and unwinding of Quantitative Easing (QE) which has further pushed up longer dated bond yields, was the ultimate cause of SVB’s demise. Secondly, the fact that the public sector stepped in to protect uninsured depositors shows that even a medium-size commercial bank can now be considered ‘too big to fail’.

The SVB collapse was closely followed by Swiss regulators allowing UBS to rescue Credit Suisse by acquiring it. These events show that government officials in both the US and in Europe are currently being extra vigilant about the stability of the global financial system. The SVB collapse is a manifestation of what we have been saying for a while – monetary tightening on this scale and speed was always going to hurt and probably lead to a recession. The problems in the banking sector will have knock-on effects on the real economy.

The turmoil in the banking sector has not prevented the Fed from raising the federal funds rate by another 25 bps on 22 March. According to the FOMC members’ March statement, the US banking system is “sound and resilient”. However, we believe the latest events in the banking sector will inevitably tighten lending conditions in the US and reduce spending. The tone of Powell’s latest speech suggests that the end of the current rate hike cycle is finally in sight. We expect the Fed to announce one final 25 bps rate hike in May 2023 and pause to see what 475 bps worth of rate hikes in slightly over a year will do to the US economy. Overall, the latest developments in the banking sector and further monetary tightening by the Fed reinforce our view that 2023 will see recessions in the US and Europe and increase the probability of a sharper recession – although this is still not our central case.

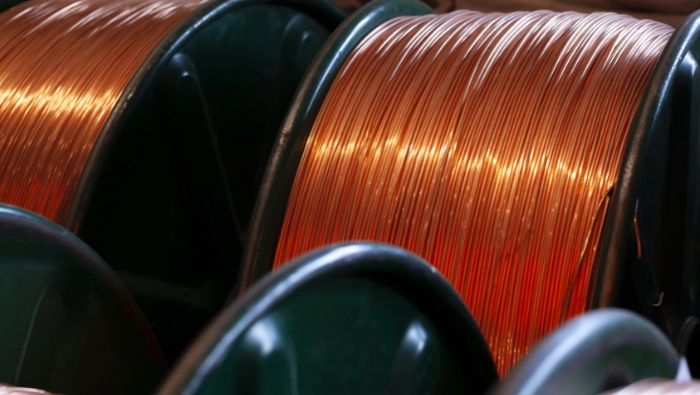

In our recently published insight, we discuss in greater detail what led to the SVB closure, whether a domino effect is likely, and the possible impact of the SVB closure and Credit Suisse acquisition by UBS on commodity markets.

These and other economic developments that impact commodity markets are discussed with CRU subscribers regularly. To enquire about CRU services or to discuss this topic in detail, get in touch with us.

CRU experts discussed the impact of the war in Ukraine on commodity markets in a recent webinar. Experts from all major commodity areas joined CRU’s Head of Economics and an energy specialist to discuss markets one month on from the invasion of Ukraine. The webinar is available to watch on-demand here.