Financial institutions are further incorporating Environmental Social and Governance-related guidelines – or “checkboxes” – to qualify a particular project financing deal. As such, mining companies developing projects that check all the boxes will likely have access to wider pools of capital for project financing and at more favourable terms. This Insight suggests that investors and mining companies can capture a premium for shareholders measured in capital performance and equity capital requirements as a result of cheaper capital – and not as a market-driven premium on price.

Balancing capital allocation, growth and risk

Mining companies are facing the challenge of a surge in capital expenditures to develop projects and sustain operations, while being scrutinised by investors for capital allocation in volatile market conditions. Moreover, the industry has set strict sustainability goals including net-zero, water and tailings management targets, among others. Regardless of these efforts, the demand-side of the market has not responded with a price premium for “greener” copper despite its importance as a key commodity in the green transition.

In this context, this Insight sets a different point of view to address the dichotomy that mining companies and investors are facing. In fact, the analysis suggests operations and projects are able to capture a premium for shareholders, through the capacity to access more competitive project financing for their growth development plans, which in return yields increasing performance of their shareholders’ capital.

On average, competitive financing can yield 41% higher equity capital performance

Banks, funds and financial institutions are increasing their threshold requirements in ESG and risk standards for new investments. The number of factors influencing the decision process of these institutions is evolving, and for the case of mining it includes a broader range of aspects, from environmental footprint to geopolitics, as reviewed in the box below.

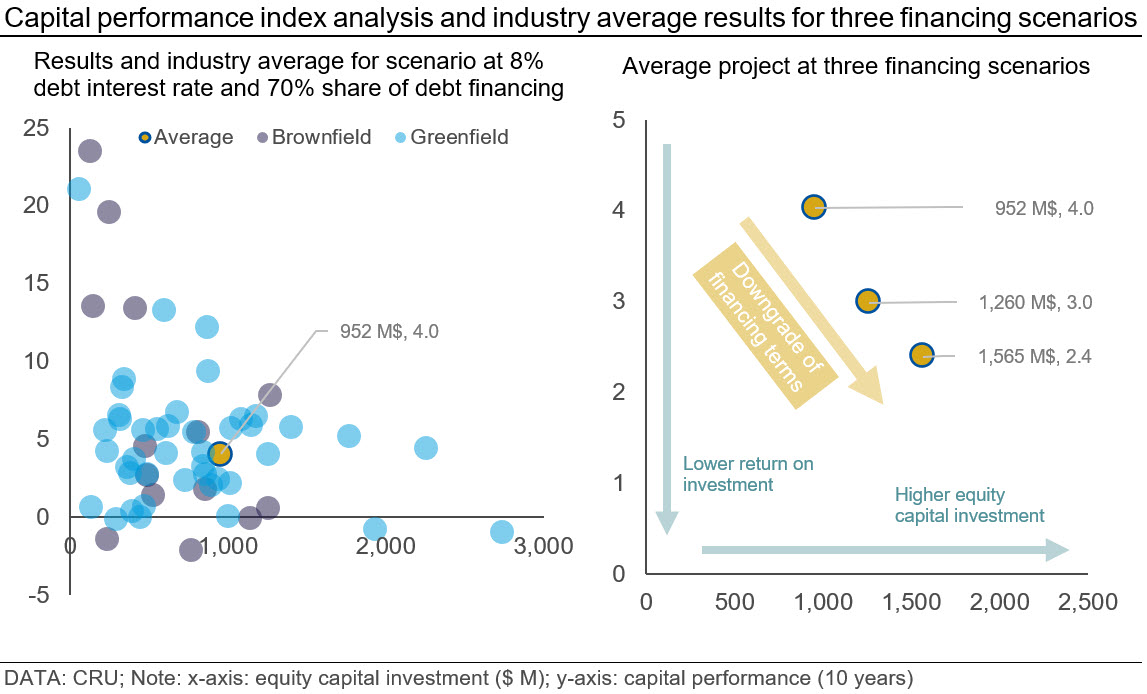

How does increased adherence to ESG principles affect the financial outcomes of projects, as well as the capital allocation strategy and shareholder returns for mining companies? The analysis presented here tackles one key aspect – the cost of capital for project financing. In particular, we evaluated the equity capital investment and performance of 14 brownfield and 43 greenfield copper projects under three different debt financing scenarios. The premise behind the analysis is that a “more compliant” project will likely have access to a wider pool of financing alternatives and therefore more competitive terms as opposed to a “less compliant” project. The financing scenarios were the following:

The capital performance (10 years) considered is the ratio of the difference between the 10-year added free cashflow returns minus the equity capital investment, over the equity capital investment. Thus, represents the performance – or return – of deploying equity capital in the development of a project.

The results show that under a positive project financing scenario, the average capital performance index for this pool of projects is ~4.0 for an average $952 M equity investment. As the financing terms deteriorate, the average index would decrease up to ~2.4 for an average $1,565 M investment. This means, that the average project that can access competitive finance alternatives would increase its capital deployment performance in 41% while decreasing its overall equity expenditure in 64% when compared to scenario with poorer project financing terms.

What about the green premium?

The free cashflow analysis considered different assumptions and inputs, namely CRU’s Cost Analysis Tool database, to forecast annual production and costs as well as a long term copper price forecast of 3.70 $/lb (real $2023) – refer to CRU Copper Long Term Outlook. In order to derive a proxy for an actual copper price premium to the capital performance analysis, the following question can be addressed –What long term copper price a project with poor access to financing would need to reach the capital performance of a “premium” project?

As shown below, the average project evaluated at the two least favourable terms considered here would require a long-term price of 4.27 $/lb and 4.85 $/lb (real US$2023) to deliver the same capital performance for equity investment as one would experience with the most favourable financing terms.

This analysis is not intended to derive a price forecast, but to highlight how differentiating factors between projects and companies could translate into higher performance in capital allocation and ultimately investors value. These factors are in many cases those related to “greener” footprint and overall ESG compliance. As such, integral ESG-related strategies should be able to reflect its net positive effect and relative premium to the market.