Steel is a crucial element of offshore wind projects and as the renewables sector grows so will the large mutual dependency that exists between steel mills and the offshore wind industry. Challenges like security of supply, carbon footprint and management of price risk will be faced and resolved by both sides of the supply chain.

This article appears in a new report on offshore wind from the Global Wind Energy Council (GWEC), of which CRU is a sponsor.

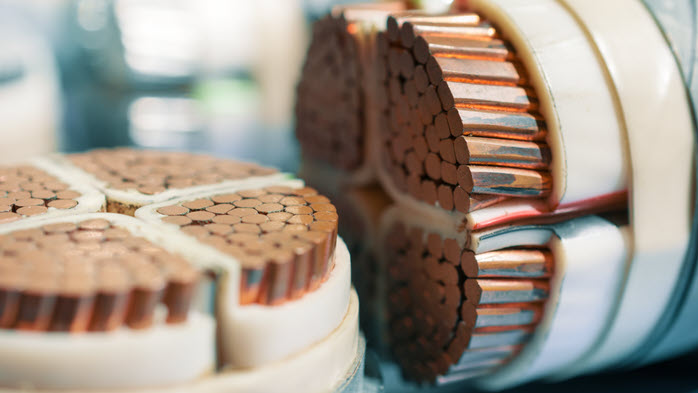

Steel is a crucial element of offshore wind projects. It is used to build the tower, transition piece, offshore substation and most importantly the foundation. A monopile foundation is essentially a big steel tube driven into the seabed. Supporting a large turbine out at sea presents a challenge for material strength and durability and steel plate provides an excellent response to that challenge.

Plate is a steel product defined as a flat-rolled steel of more than 4.75 mm thickness. Offshore wind typically requires thicker plates than other applications, even as much as 150 mm. The sector has developed rapidly to become the key demand growth driver for this niche steel in Europe. Similar dynamics are now emerging in Asia and North America as the European offshore experience spreads.

From the steel mills’ perspective, offshore wind is a big deal. CRU calculates that 15–20% of European demand for reversing mill plate comes from wind. We expect this to increase past 25% within 5 years, driven by offshore. In Asia, the share of wind in plate demand is smaller, yet also rising, and Asia is a plate market around 10 times the size of Europe. Longer term, floating wind solutions look to be even more steel-intensive than fixed bottom installations.

But if we look at the relationship from the other end, steel is also a big deal for the offshore wind sector, with 25% of capex, coming from foundation and tower1.

There is thus a huge mutual dependency between steel producers and offshore wind developers. In that context the following key challenges for both sides can be highlighted:

- Security of supply. Amid competing demands there is a need to ensure that the right amount of the right steel can be secured at the right time. The world market is complex and always changing, subject to multiple forces. Business intelligence to support managing that complexity is vital.

- Supply chain carbon footprint. Strategies to decarbonise supply chains are widespread and have a particular resonance within renewable energy. Offshore wind will be a strong future source of demand for low-CO2 But steel is a ‘hard to abate’ sector with enormous technological and commercial challenges to decarbonise. CRU’s Emissions Analysis Tool shows that on average it emits almost 2t CO2/t liquid steel.

- Managing price risk in volatile markets. Offshore wind requires large volumes of steel over long time periods. But steel prices are volatile. For example, the price of steel plate in Germany increased by over 120% between July 2020 and July 2021. Many companies in the offshore wind supply chain are choosing to manage this price risk by indexing their commercial contracts to CRU’s steel prices.

Notes: 1: IRENA (2016), The Power to Change: Solar and Wind Cost Reduction Potential to 2025.

Interested in related insights?

Learn more about CRU's insight series, Steel and the green energy transition.

Similarly, our steel plate market outlook report provides subscribers with in depth coverage of the global plate market through the next five-years with detailed production and consumption data and analysis. Get in touch below for questions or further information.